By Cory Turner

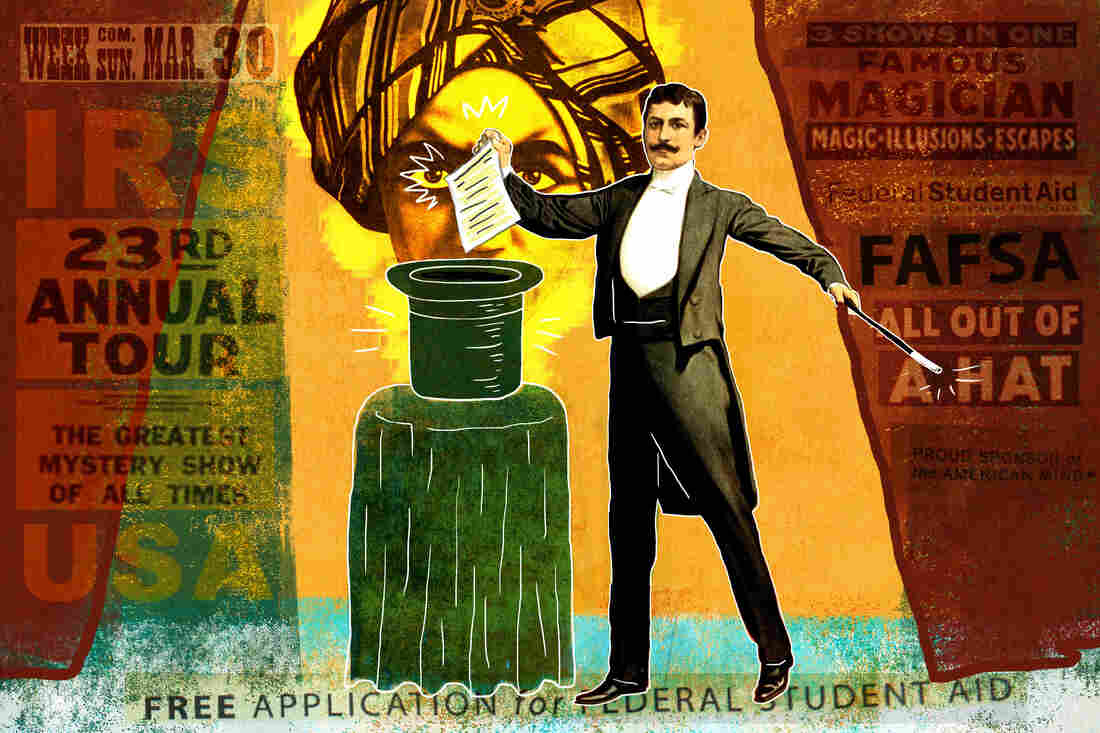

LA Johnson/NPR

There is big news today for prospective college students and their parents. It comes from Education Secretary Arne Duncan, who is in Iowa with President Obama for his annual Back to School Bus Tour.

“Today, we’re lending a hand to millions of high school students who want to go to college and who’ve worked hard,” Duncan said. “We’re announcing an easier, earlier FAFSA.”

That’s the Free Application For Federal Student Aid. With more than 100 questions, it’s a gatekeeper for students hoping to get help paying for college.

“It’s really a win-win for everybody,” says Justin Draeger, president of the National Association of Student Financial Aid Administrators. “Ultimately, this is gonna mean less work for [students] and less work for schools.”

Usually, students start applying to colleges in the fall, then apply for financial aid in January — when the FAFSA comes out. But that means that many find themselves accepted by a college before they know how much help they’re getting. The new plan would release the FAFSA in October instead of January.

“Very excited” was Margaret Feldman’s reaction. She’s the director of college advising for the Scholarship Fund of Alexandria, Va. Feldman is based at T.C. Williams High School and says that, under the old system, “students were coming in — seniors who had just graduated — who still did not have a financial aid award letter. And so they’d committed to a school, and in August they still didn’t know how much they were going to have to pay.”

Under the new timeline, that’s far less likely to happen.

So, that’s the earlier. Now the part about making the FAFSA easier.

Six months ago, I reported on one thing the government could do to fix the FAFSA. Rachel Fishman, who studies education policy at New America, explained it this way:

“There’s a new IRS data-retrieval tool where parents and students can log onto the IRS through FAFSA, and it will pre-populate much of the form.”

A student’s dream come true: The IRS filling out much of the FAFSA for you!

The problem is, the FAFSA requires parents’ tax information from the prior year. And some 4 million students apply for aid each year before their families’ taxes have been filed. So this great IRS tool … can’t help them.

Well, starting in October of 2016, the FAFSA will require parents’ tax info from the “prior-prior” year instead. That opens the door for the IRS to automatically fill out a big chunk of just about everyone’s FAFSA.

Education Secretary Duncan said Monday morning that he expects the changes will lead to hundreds of thousands of additional students applying for federal Pell grants, though he called the costs “very, very minor.”

By minor he means roughly a 1 percent increase in federal Pell Grant spending — about $400 million.

These FAFSA changes come on the heels of another big push from the White House — the Saturday release of its “College Scorecard.”

It isn’t a rating or ranking system (as many had expected) but a massive collection of data — much of it available for the first time — that students and parents can use to judge colleges for themselves. Among the more than 1,700 variables (for more than 7,000 colleges) are the percentage of recent students paying down principal on their loans, and the average earnings of a school’s graduates.

Anyone looking at colleges should consider rummaging through the data. Call it a useful homework assignment — from the White House.

This entry passed through the Full-Text RSS service – if this is your content and you’re reading it on someone else’s site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.