Saudi Aramco, World’s Most Profitable Company, Will Make First Public Offering

President and CEO of Saudi Aramco Amin Nasser and company chairman Yasir al-Rumayyan at a press conference in Dhahran, Saudi Arabia on Sunday. The privately-owned oil giant announced it will IPO next month.

AFP via Getty Images

hide caption

toggle caption

AFP via Getty Images

The world’s most profitable company will make its first public stock offering next month, in what could be the biggest IPO ever.

Saudi Aramco, the oil giant owned by the Saudi government, said on Sunday it will sell an unspecified number of shares, thought to be between 1% and 3% of the company. It did not specify a price range.

The company’s initial offering will be on Saudi Arabia’s Tadawul exchange. “We are proud of the listing of Aramco,” said CEO and President Amin Nasser said. “It will increase our visibility internationally.”

It has taken years to get to this moment. Saudi Crown Prince Mohammed bin Salman said in 2016 that he wanted the company to go public in 2017, and that it would be valued at $2 trillion. But getting its books ready has taken until now, and bankers have advised that the valuation should instead be around $1.5 trillion.

Aramco supplies about 10% of the world’s crude oil. In 2018, the company made $111 billion. That’s more than J.P. Morgan Chase, Facebook, ExxonMobil and Google parent company Alphabet put together, as CNBC pointed out.

The firm’s finances have long been guarded, but it began sharing its numbers in preparations for the IPO.

Its disclosures show that it costs Aramco $2.80 to get a barrel of oil from the ground, which it can then sell for $62 per barrel, according to The Guardian.

“It produces oil for so much less than anyone else out there,” says Ellen Wald, author of Saudi, Inc., a book about the history of Saudi Arabia and Aramco. “I mean in the United States a fracking company is lucky if it can break even at $50 a barrel.”

That’s just one part of what makes Aramco so profitable. The company also benefits from investments it has made in its infrastructure, which makes it cheap to pump its oil. Then there’s the accessibility of its oil reserves.

“These are the largest conventional oil resources on the planet,” Wald says.

The public offering is part of an effort by the crown prince to diversify Saudi Arabia’s economy and make it less dependent on oil. The move comes less than two months after Aramco’s oil facilities were attacked by drone strikes, which for a time halved the country’s oil exports. Yemen’s Houthi rebels claimed responsibility, but Saudi Arabia pointed the finger squarely at Iran.

Those attacks, among other geopolitical issues, have raised questions about the safety of an investment in Aramco.

Credit rating agency Fitch recently downgraded Saudi Arabia’s rating from A+ to A, citing “increased geopolitical and military tensions in the Gulf region,” in addition to “the vulnerability of Saudi Arabia’s economic infrastructure, and continued deterioration in Saudi Arabia’s fiscal and external balance sheets.”

Aramco chairman Yasir al-Rumayyan downplayed those concerns at a press conference Sunday.

After the attacks on its oil facilities, “oil prices went up the first two days by about 20%. Then it came down by 10%,” Rumayyan said. “We have one eighth of the oil production in the world, and the oil traders saw this as a non-event. That means it is really safe. That’s what the money is saying.”

For the people of Saudi Arabia, the IPO is a huge deal.

“This is their crown jewel,” says Wald. “Many Saudis see this as an opportunity to actually invest in the incredible natural resource that was endowed to their country.”

Saudi investors will be incentivized to buy: They’ll be eligible for one extra share for each 10 they buy within the first 180 days.

But for investors elsewhere, the prospect of buying Aramco shares may be more complicated. The company is essentially owned by the Saudi royal family. In September, Crown Prince Mohammed belatedly acknowledged that he was accountable for the October 2018 murder of journalist Jamal Khashoggi because “It happened under my watch,” though he did not accept responsibility. The country only lifted its ban on women driving last year, and continues to have a guardianship system that limits women’s rights.

And then there’s Aramco’s environmental record. An investigation by The Guardian found that the company is responsible for 4.38% of the world’s carbon emissions since 1965.

With all that in mind, some investors may not want their pension funds to buy shares of Aramco stock.

“People have issues with Saudi Arabia: with their treatment of women, their issues with human rights. They have issues with fossil fuels,” Wald says. “So people should be aware that this is happening and that this is something that can touch their investments, even if they don’t know it. Even if they haven’t actively decided to go into this.”

But no matter what, Wald predicts the IPO will be a historic moment.

“It will also be the first time that people get a chance to really see Aramco’s books,” she says. “It’s long been this kind of shadowy, mysterious company that has held its secrets very close to its chest. And the idea of of getting inside that and taking a look or a peek inside is really fascinating to a lot of people.”

Trump Takes In UFC Fight In NYC, Days After Tweeting Residency Change To Florida

President Donald Trump speaks to the media before boarding Marine One on the South Lawn of the White House. He’s expected to spend the weekend in New York and take in a UFC fight.

Bloomberg/Bloomberg via Getty Images

hide caption

toggle caption

Bloomberg/Bloomberg via Getty Images

Politics is often described as a rough and tumble business. But President Donald Trump is expected to witness an actual blood sport when he takes in a much-hyped mixed martial arts event on Saturday at Madison Square Garden in New York.

This will be Trump’s second sporting event in the span of a week. On Sunday, he attended Game 5 of the World Series at Nationals Park in Washington, where he was met with boos and chants of “lock him up.”

Trump’s visit to New York comes just two days after announcing he and his family are switching their permanent residency from New York to Florida, a move that was met with cheers from some of several prominent Democrats in the state. Explaining his decision on Twitter, Trump said he lamented being “treated very badly by the political leaders” in New York.

Trump who was born, raised, built his businesses and launched his political campaign in New York, says he “hated” to have to make the decision to leave, but that “few have been treated worse” by the city and state elected officials.

He’s switching his residence to Palm Beach, Fla., where he owns the Mar-a-Lago resort, a place he’s dubbed the “winter White House.” Trump has resisted calls to release his state or federal taxes, but by switching residences, he’d go from a city that taxes top earners a 3.876% tax rate, and a state with a top rate of about 9% to Florida, which has no state income tax.

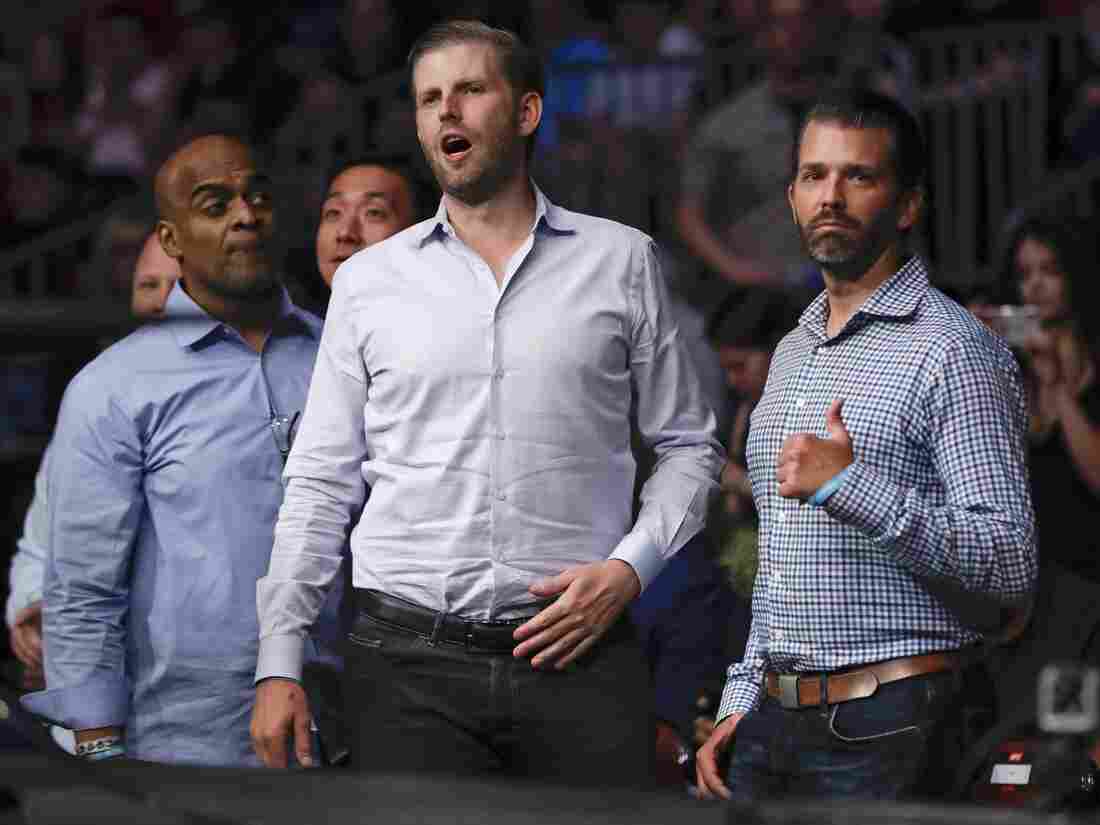

Donald Trump Jr., right, poses for a photo with Eric Trump at UFC Fight Night Saturday, Aug. 3, 2019, in Newark, N.J.

Frank Franklin II/AP

hide caption

toggle caption

Frank Franklin II/AP

Before that paperwork is finalized however, he’s expected to spend much of the weekend in the Big Apple, starting with attending the UFC 244 tournament, headlined by Nate Diaz and Jorge Masvidal. The main event is for a new belt and “title” of BMF, an acronym for “Baddest Motherf*****.”

According to TMZ Sports, the belt cost $50,000 to make and other notables expected to attend include wrestler-turned-actor Dwayne “The Rock” Johnson and New England Patriots owner Robert Kraft.

Trump’s Connection to Mixed Martial Arts

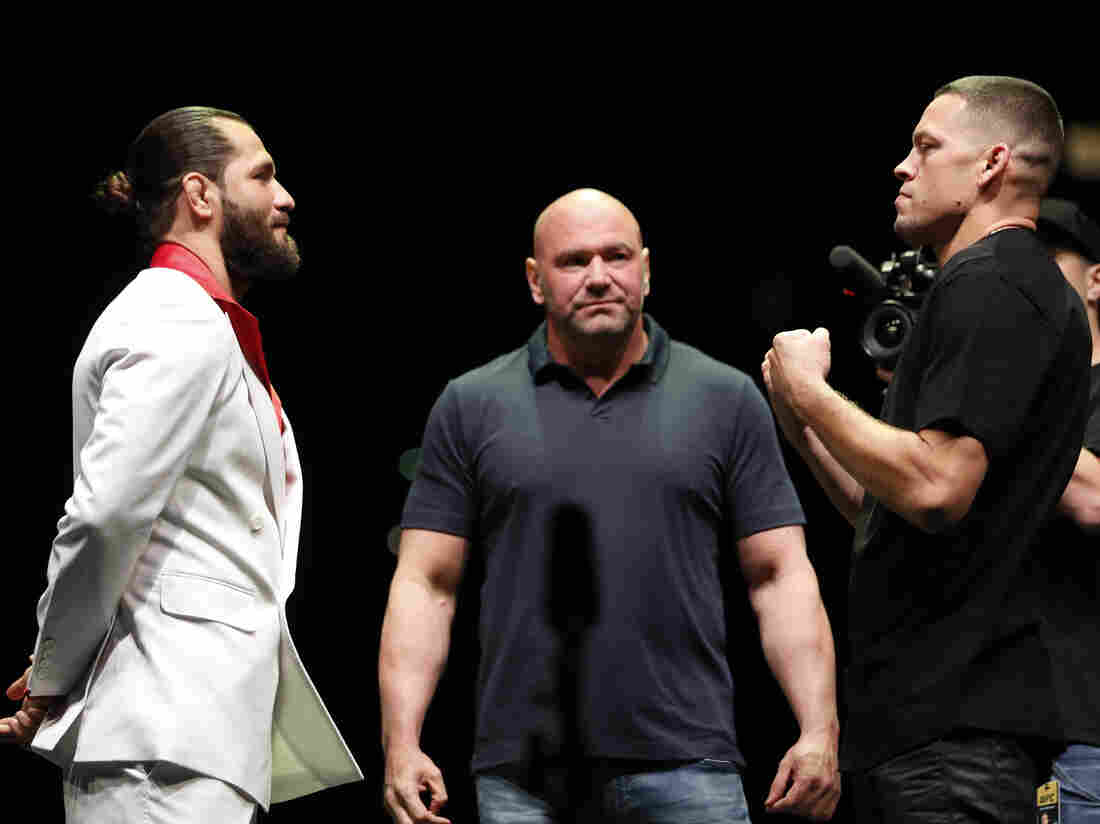

UFC President Dana White, center, at a press conference ahead of UFC 244 scheduled for Saturday in New York City. The main event is between Jorge Masvidal, left, and Nate Diaz.

Michael Owens/Zuffa LLC

hide caption

toggle caption

Michael Owens/Zuffa LLC

While a MMA match may strike some as an unusual place for a commander-in-chief to spend a Saturday night, NPR’s Scott Simon pointed out on Saturday’s Weekend Edition that “the president is a fan and used to book MMA events at his casino in Atlantic City.”

Trump’s dealings with Ultimate Fighting Championship and its President Dana White, go back to 2001 when UFC 30: Battle on the Boardwalk was held at Trump’s Taj Mahal in Atlantic City.

Back then, it was a huge score for the UFC to land a venue like Trump’s. The sport had suffered for years, being banned in several states and disparaged as “human cockfighting” by the late Arizona Sen. John McCain.

In a 2018 interview with The Hill, White spoke about MMA’s “stigma” and that “venues didn’t even want us.”

“I will never say anything negative about Donald Trump,” White said at the time. “He was there when other people weren’t.”

White said he and Trump remain close, even though, for a time, Trump partnered with a rival mixed martial arts outfit called Affliction Entertainment in 2008. Affliction soon tapped out, but the UFC has scrapped its way to being a multi-billion-dollar industry, selling for just over $4 billion in 2016.

“Any good thing that happened to me in my career, Donald Trump was the first to pick up the phone and call and say ‘congratulations, I knew you guys were going to do this,'” White told The Hill.

A month prior to UFC’s sale, White spoke at the 2016 Republican National Convention, something he said he was “blown away and honored” to do.

“Donald championed the UFC before it was popular, before it grew into a successful business,” White said before a crowd gathered in Cleveland.

“I will always be grateful, so grateful to him for standing with us in those early days. So tonight, I stand with Donald Trump.”

Trump is expected to stay overnight at the Trump Tower in New York on Saturday. He is expected to depart on Sunday, and perhaps add to the traffic congestion that’s already anticipated for the New York City Marathon.

YouTube

Calif. Governor Seeks To ‘Jumpstart’ PG&E Bankruptcy Talks; Threatens State Takeover

From left, LA City Councilman Mike Bonin, California Gov. Gavin Newsom and LA Mayor Eric Garcetti tour a burned home in Brentwood, Calif., on Tuesday.

Wally Skalij/AP

hide caption

toggle caption

Wally Skalij/AP

California Gov. Gavin Newsom said Friday that he wants to speed up Pacific Gas & Electric’s bankruptcy case, calling on the beleaguered utility’s executives, creditors and shareholders, as well as wildfire victims, to reach “a consensual resolution” to the negotiations before next year’s wildfire season.

“We want to broker that mediation and are calling on all the parties to come in early next week to jumpstart those negotiations,” Newsom said in a Sacramento news conference.

Newsom left little doubt that he is looking beyond the PG&E bankruptcy case and that he envisions a future in which the state takes an active role in restructuring the California’s largest utility.

“It is my hope that the stakeholders in PG&E will put parochial interests aside and reach a negotiated resolution so that we can create this new company and forever put the old PG&E behind us,” Newsom said in statement. “If the parties fail to reach an agreement quickly to begin this process of transformation, the state will not hesitate to step in and restructure the utility.”

PG&E filed for bankruptcy in January when it faced a flood of lawsuits related to California’s wildfires in 2018 caused by its equipment, with potential liabilities estimated at about $30 billion.

California lawmakers over the summer gave PG&E a deadline of June 30, 2020, to exit bankruptcy or forfeit billions of dollars in a state fund established to help utilities pay for future wildfire claims. The law also requires PG&E to spend at least $5 billion on safety improvements to access the fund.

“PG&E, as we know it, cannot persist and continue,” Newsom said in the news conference. “Everybody objectively acknowledges and agrees with that. It has to be completely transformed.”

The Democratic governor also announced that he is appointing his cabinet secretary, Ana Matosantos, as his “de facto energy czar” to help his administration to figure out what “a 21st century utility looks like.”

Newsom’s remarks follow critical comments he has made all week about PG&E as he toured the state’s wildfire areas. He has repeatedly said the power outages imposed in order to mitigate wildfire dangers were “unacceptable.”

“This is not the new normal and this does not take 10 years to solve,” Newsom said.

That remark was an apparent swipe at PG&E Corp. President Bill Johnson who said last month that utility customers could anticipate power outages for the next decade.

Opinion: Syria’s Oil Output Is Low, But Here’s Why It Matters

Twitter To Halt Political Ads, In Contrast To Facebook

Twitter will stop running political ads, CEO Jack Dorsey announced Wednesday. Online political ads pose “significant risks to politics,” he tweeted.

Denis Charlet/AFP/Getty Images

hide caption

toggle caption

Denis Charlet/AFP/Getty Images

Updated at 6:04 p.m. ET

Twitter CEO Jack Dorsey announced that his social media platform will stop running political ads, citing online ads’ “significant risks to politics.” Facebook has been criticized for allowing deceptive political ads.

“We’ve made the decision to stop all political advertising on Twitter globally. We believe political message reach should be earned, not bought,” Dorsey tweeted late Wednesday afternoon.

He explained his reasons in a long thread of tweets.

We’ve made the decision to stop all political advertising on Twitter globally. We believe political message reach should be earned, not bought. Why? A few reasons…?

— jack ??? (@jack) October 30, 2019

“A political message earns reach when people decide to follow an account or retweet,” Dorsey wrote. “Paying for reach removes that decision, forcing highly optimized and targeted political messages on people. We believe this decision should not be compromised by money.

“While internet advertising is incredibly powerful and very effective for commercial advertisers, that power brings significant risks to politics, where it can be used to influence votes to affect the lives of millions.”

He said that online political ads “present entirely new challenges to civic discourse: machine learning-based optimization of messaging and micro-targeting, unchecked misleading information, and deep fakes. All at increasing velocity, sophistication, and overwhelming scale.”

In an apparent jab at Facebook CEO Mark Zuckerberg, Dorsey tweeted, with a wink emoji: “it’s not credible for us to say: ‘We’re working hard to stop people from gaming our systems to spread misleading info, buuut if someone pays us to target and force people to see their political ad…well…they can say whatever they want!’ “

For instance, it‘s not credible for us to say: “We’re working hard to stop people from gaming our systems to spread misleading info, buuut if someone pays us to target and force people to see their political ad…well…they can say whatever they want! ?”

— jack ??? (@jack) October 30, 2019

Dorsey was referring to Zuckerberg’s decision not to block political speech on Facebook, even if it contains misleading statements.

“Our policy is that we do not fact-check politicians’ speech, and the reason for that is that we believe that in a democracy, it is important that people can see for themselves what politicians are saying,” Zuckerberg told a U.S. House committee last week.

This afternoon, Zuckerberg again defended Facebook’s policy on not checking politicians’ ads during a conference call about the company’s financial performance.

“We need to be careful about adopting more and more rules that restrict the way people can speak and what they can say,” Zuckerberg said.

But critics, including several Facebook employees, say the policy gives politicians free rein to lie and makes it easy to spread those lies.

Facebook workers posted an open letter with 250 signatures to the company’s internal message board, urging Facebook to hold political ads to the same standards as other ads, including being fact-checked.

President Trump’s political campaign criticized Twitter’s move, saying the company is turning its back on a lot of money.

“This is yet another attempt to silence conservatives, since Twitter knows President Trump has the most sophisticated online program ever known,” said Brad Parscale, Trump’s political campaign manager.

Loading…

While all the major Democratic candidates have spent money on Twitter advertising, two have cleared the $1 million mark, according to figures provided by the company

Former Texas Rep. Beto O’Rourke and California Sen. Kamala Harris have each spent $1.1 million with Twitter. Their campaigns did not immediately return requests for comment on how Twitter’s decision could affect their strategy.

NPR’s Alina Selyukh and NPR’s Sean McMinn contributed to this report.

Boeing CEO Faces Tough Questions From Lawmakers Over Safety Of 737 Max

Boeing’s CEO faced tough questions on Capitol Hill Tuesday about design flaws that caused two deadly 737 Max plane crashes. Though admitting making mistakes, some of his answers angered lawmakers.

MARY LOUISE KELLY, HOST:

The CEO of Boeing faced withering criticism today over the company’s role in the crashes of two 737 MAX airplanes. Dennis Muilenburg was testifying before a Senate committee – tomorrow, same drill before a House committee. The first of those crashes happened exactly one year ago in Indonesia, and that was when a Lion Air jet plummeted into the Java Sea shortly after takeoff. The other crash was in Ethiopia this past March. NPR’s David Schaper joins me.

Hey, David.

DAVID SCHAPER, BYLINE: Good afternoon.

KELLY: Hey. Does – so describe the mood in that Senate hearing room today.

SCHAPER: You know, it was both somber and tense at times. You know, Boeing CEO Dennis Muilenburg sat at a table with the company’s chief engineer John Hamilton. Well, right behind them – just a couple of rows behind them – were several family members and loved ones of some of the 346 people who died in the crashes in Indonesia and Ethiopia. And Muilenburg emotionally addressed them first.

(SOUNDBITE OF ARCHIVED RECORDING)

DENNIS MUILENBURG: On behalf of myself and the Boeing company, we are sorry – deeply and truly sorry.

SCHAPER: Muilenburg went on to acknowledge that the company made mistakes and got some things wrong with the 737 MAX. He talked about some new safety protocols and procedures that the company is instilling and also some new channels for employees who have their own safety concerns – how they can raise those internally at the company.

KELLY: So he’s talking about changes they want to make going forward, but did he get into specifics about what went wrong?

SCHAPER: He did. He admitted that both crashes involved this new flight control system that activated in response to a single faulty sensor, and the company’s chief engineer acknowledged that there was a – they made a mistake by not adequately testing it. Senators demanded to know, though, how that system, called MCAS, could have had a single point of failure and – when redundancies have now long been the norm in aviation engineering. They also demanded to know why pilots were not even told that the safety critical system existed. With some of the audience holding up pictures of those killed in the crash, Connecticut Democrat Richard Blumenthal tore into Muilenburg.

(SOUNDBITE OF ARCHIVED RECORDING)

RICHARD BLUMENTHAL: Those pilots never had a chance. These loved ones never had a chance. They were in flying coffins as a result of Boeing deciding that it was going to conceal MCAS from the pilots.

KELLY: You do get a sense of the tension in that room today from just listening to that tape. David, I want to ask about a couple lines of reporting that you have been following as you’ve worked this story – that allegations of pressure inside Boeing to speed the development and the certification of this plane and also whether the FAA and Boeing got a little bit too cozy. Did that come out in this – in the hearing today?

SCHAPER: You know, this was one of those things that the senators asked about time and time again and tried to pressure CEO Muilenburg about. He acknowledged that, you know, scrutiny of Boeing’s safety culture is certainly warranted and fair. But he still would not agree with those who contend that safety sometimes took a back seat to profitability at the corner – at the company, nor that, you know, any corners were cut in order to keep costs down. He also disagreed with characterizations that the company had become too cozy with the FAA.

When pressed on recently revealed internal messages between senior pilots at the company – this was from three years ago, and these pilots detailed problems with the flight control system – Muilenburg told the committee he knew about these early this year but that he just knew that they existed; he never actually read them. And that set off Republican Ted Cruz, who chairs the Aviation Subcommittee. He was just livid.

(SOUNDBITE OF ARCHIVED RECORDING)

TED CRUZ: You’re the CEO. The buck stops with you. Did you read this document? And how did your team not put it in front of you, run in with their hair on fire, saying, we got a real problem here? How did that not happen, and what does that say about the culture at Boeing?

SCHAPER: Muilenburg’s response was that he just turned it over to legal counsel and thought that they would take care of it and put these through the proper channels. Other senators got mad, accusing Muilenburg of half-truths and misleading information.

KELLY: Right.

SCHAPER: And some pressed the CEO on why the company pushed regulators to allow these MAX planes all around the world to keep flying after they first crashed.

KELLY: David, we’ll leave it there. That’s NPR’s David Schaper.

Thanks.

Copyright © 2019 NPR. All rights reserved. Visit our website terms of use and permissions pages at www.npr.org for further information.

NPR transcripts are created on a rush deadline by Verb8tm, Inc., an NPR contractor, and produced using a proprietary transcription process developed with NPR. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.

FACT CHECK: President Trump’s Plans For Syrian Oil

Oil well pumps are seen in Syria’s northeastern Hasakeh province in 2015. President Trump is renewing his push for U.S. control of Syrian oil.

Youssef Karwashan/AFP/Getty Images

hide caption

toggle caption

Youssef Karwashan/AFP/Getty Images

President Trump is renewing his push for U.S. control of Syrian oil. But experts say there’s not much oil there, and what there is belongs to the Syrian government.

Still, the idea of controlling the oil fields is one that has long appealed to Trump. And it may provide a rationale for maintaining a U.S. military presence in Syria, reversing the president’s promise of a full withdrawal.

“We are leaving soldiers to secure the oil,” Trump told reporters on Sunday, while announcing the death of ISIS leader Abu Bakr al-Baghdadi. “And we may have to fight for the oil. It’s OK. Maybe somebody else wants the oil, in which case they have a hell of a fight. But there’s massive amounts of oil.”

In fact, in the best of times Syria produced only about 380,000 barrels of low-quality oil per day. And production has fallen more than 90% during the country’s long civil war. Last year, Syria ranked 75th among countries in the world in oil production, with a daily output comparable to that of the state of Illinois.

“Syrian oil was never important to the world market because production was so small,” said energy expert Daniel Yergin of IHS Markit. “But it was very important to the Assad regime before the civil war because it produced 25% of the total government revenues.”

Trump on Sunday floated the idea of modernizing Syria’s productive capacity with help from a major oil company.

“What I intend to do, perhaps, is make a deal with an Exxon Mobil or one of our great companies to go in there and do it properly,” he said.

That would be a costly undertaking, according to Joshua Landis, who directs the Center of Middle East Studies at the University of Oklahoma.

“This whole oil region needs to be rebuilt,” Landis said. “So if America is going to get in the business of retaining these oil fields, it will have to invest hundreds of millions of dollars, in theory, to make them exploitable.”

Trump has argued for years that the U.S. should seize Middle Eastern oil fields to recoup some of the cost of its military operations in the region — an idea that experts say violates international law and would only fuel criticism of American intentions.

“In the old days, you when you had a war, to the victors belong the spoils,” Trump told ABC news in 2011.

Emory law professor Laurie Blank says that notion is outdated. “International law seeks to protect against exactly this sort of exploitation,” Blank told Reuters.

Sen. Lindsey Graham, R-S.C. — who bitterly criticized the president’s abrupt decision earlier this month to withdraw U.S. troops from Syria — seized on the oil fields as an argument for a continued American presence in the region.

“By continuing to maintain control of the oil fields in Syria, we will deny Assad and Iran a monetary windfall,” Graham said in a statement last week that echoed Trump’s own language. “We can also use some of the revenues from future oil sales to pay for our military commitment in Syria.”

That position appears to have struck a nerve with Trump.

“I spoke with Lindsey Graham just a little while ago,” Trump said Sunday. “Where Lindsey and I totally agree is the oil.”

For Graham and others, the oil fields may be a way to appeal to the president’s transactional instincts and overcome Trump’s aversion to an open-ended deployment in Syria.

“There are many elements of our foreign policy establishment that want to roll back Iran and want to stay in Syria for the long haul,” Landis said. “Throwing the oil wells in front of President Trump was a way I think they believed that they could reanimate his interest in staying in Syria.”

Do Robots Or Trade Cost Jobs?

NPR’s Danielle Kurtzleben talks about whether automation and robots, or bad trade policies pose a bigger threat to jobs in America.

Nearly 1 Million Customers To Lose Power In Planned PG&E Power Outages

The Kincade Fire burns through the Jimtown community of Sonoma County, Calif., on Thursday.

Noah Berger/AP

hide caption

toggle caption

Noah Berger/AP

Pacific Gas and Electric has expanded its power blackout zone to 940,000 customers across Northern and Central California as extreme weather forecasts threaten to increase the risk of wildfires.

The projected wind gusts of up to 70 mph, combined with dry vegetation, create prime conditions for wildfire.

“Winds of this magnitude pose a higher risk of damage and sparks on the electric system and rapid wildfire spread,” PG&E said in a statement. “The fire risk is even higher because vegetation on the ground has been dried out by recent wind events.”

The planned power outages will affect roughly 90,000 more customers than previous estimates by the utility. Over the course of two to three days, the shutoffs could leave more than 2.5 million people in the dark.

“Charge any devices you might need, have water and nonperishable foods at your disposal, and if you have special medical needs, please be sure to have access to support and resources,” PG&E’s President Andy Vesey said Friday.

Dry, hot and windy conditions were expected to hit the region between 6 p.m. and 10 p.m. Pacific time Saturday and last through Monday afternoon.

“This wind event is forecast to be the most serious weather situation that Northern and Central California has experienced in recent memory,” said Michael Lewis, PG&E’s senior vice president of electric operations.

When compared to the conditions that fueled the deadly October 2017 wildfires that ripped through Northern California, these winds not only have the potential to be stronger but also the potential to last longer, according to National Weather Service meteorologist Steve Anderson.

“The peak winds during the wildfires in the North Bay in 2017 only lasted four to 6 hours,” Anderson said. “These wind speeds — we’re looking at a range of 24 to 30 hours.”

The planned shutoff is the largest intended to prevent wildfires since PG&E started conducting “public safety power shutoffs” in a handful of counties last year.

The power shutoffs will roll out in six phases, but the utility said times may change depending on weather conditions. The first round of shutoffs were expected as early as 2 p.m. on Saturday, but were delayed, according to PG&E during a press conference Saturday night. The utility said it shut off power in areas of the Northern Sierra Foothills, the Northern Sacramento Valley and the North Bay Area at 5 p.m.

Power shutoffs for the rest of the planned Bay Area regions began around 8 p.m. on Saturday, which were previously scheduled for 5 p.m.

The utility planned to cut power in 36 counties across parts of Humboldt, the Sierra Nevada foothills, Western Sacramento Valley, and every county in the Bay Area except for San Francisco. A sixth phase is scheduled for Kern County on Sunday morning.

You can find the schedule of planned power shutoff times here, and a map marking the latest outages here.

PG&E says it hopes to begin the process of restoring power on Monday.

Two large wildfires drove California Gov. Gavin Newsom to declare states of emergency in Sonoma and Los Angeles counties, which will help communities get state aide.

The Kincade Fire in Sonoma County has burned nearly 25,500 acres since it started Wednesday night, and in northwest Los Angeles, the Tick Fire has burned 4,600 acres.

The state’s largest utility is opting to shut down power lines as a precaution against conditions similar to those that fueled some of California’s most catastrophic fires. NPR previously reported that although the power utility had informed regulators that part of a transmission tower broke not far from the Kincade Fire shortly before it began, it’s not yet clear whether PG&E’s power lines are to blame for sparking the fire.

State fire investigators found PG&E’s electrical lines responsible for last year’s Camp Fire in Northern California, the state’s deadliest wildfire, that killed 85 people.

The fires also prompted billions of dollars in lawsuits and wildfire liabilities that drove the utility to file bankruptcy.

Gov. Newsom announced on Friday that the state would allocate $75 million to support communities with funding for emergency services, power generators and other public health and safety needs during the power outages.

On Saturday, Newsom reiterated criticism of PG&E that he made in a press conference a day earlier – he blamed the utility for prioritizing profit over public safety and condemned the company’s refusal to modernize its grid.

“The impact of [PG&E’s planned power outages] is unacceptable,” he said in a video posted to Twitter. “We’ve got to hold them accountable.”

Reporter Jeremy Siegel and digital producer Audrey Garces are with NPR member station, KQED.

Some Baseball Players Are Entering ‘Income Pooling’ Agreements To Fix Imbalance

A career in baseball is a gamble. A few guys make a ton of money, and most make very little. Some baseball players are taking advantage of that imbalance and entering into “income pooling” agreements.

AUDIE CORNISH, HOST:

Game 3 of the World Series is tonight, featuring baseball players earning millions of dollars. Among those watching the game, all those minor league players earning way less money. There’s a company that’s pushing a big economic idea to try and balance out that inequality. Kenny Malone of our Planet Money podcast and NPR’s sports correspondent Tom Goldman tells us about it.

UNIDENTIFIED PERSON: Got it, got it, got it.

TOM GOLDMAN, BYLINE: I met Logan Ice at spring training earlier this year.

KENNY MALONE, BYLINE: Ice is a minor leaguer who says the salary for a player like him is around $8,000 a year.

LOGAN ICE: But that doesn’t account for living. That doesn’t account for food – granted they feed you a couple of meals a day.

GOLDMAN: There are really only two options for baseball players – make the majors and make it huge or get stuck in the minors earning bupkis.

MALONE: But a company called Pando says it has a third option. Charlie Olson is the CEO and says this would work for any level of baseball player.

CHARLIE OLSON: There’s nothing that’s too low. So…

MALONE: What about right now, Kenny Malone in the studio?

OLSON: That’s too low (laughter). That’s too low.

MALONE: You’ve never even seen me throw a curve ball.

OLSON: As long as you are on contract by a professional baseball organization, you are available to be a client of Pando’s.

GOLDMAN: Pando wants minor leaguers to join what it calls income pools.

MALONE: And here’s how this works. A handful of players join a pool and make this deal. Whoever makes it big is going to kick some of their earnings back to the rest of their pool members. Also, Pando is going to get a little cut because that is their business model.

GOLDMAN: Nobody has to pay a cent until they’ve made it to the majors and they’ve made $1.6 million. Then that guy has to kick 10% of his salary back to his pool mates.

OLSON: Baseball can be zero-sum when your best friend gets called up and you didn’t. Now all of a sudden, when your best friend gets called up, a little bit of you did.

GOLDMAN: One of the first players Pando recruited was Logan Ice.

ICE: I was like, what’s the worst thing for me as a player that could happen, financially?

MALONE: And he thought, well, it only costs me money if I make it huge, and then I do have to kick money back to my pool.

ICE: That’s the worst thing that could happen to me, is I’m filthy rich…

MALONE: (Laughter).

ICE: …And I’m giving people money, and I’m helping them so much more than that money’s hurting me. If that was the worst thing that could happen to me, I’m game.

MALONE: Pando’s business model does raise some questions. For example, do irrationally confident athletes really think they need this kind of an insurance policy?

GOLDMAN: Will having that policy make them less motivated to succeed?

MALONE: The question Major League Baseball is asking is about competition. Will a pitcher go easier on a batter if they’re in the same pool, for example?

GOLDMAN: Pando’s CEO Charlie Olson isn’t worried.

OLSON: I’m sure we can all kind of agree that there are many ways in which a player might be motivated to see a player on another team succeed. And yet, at the end of the day, competition reigns.

GOLDMAN: Charlie Olson says there are now about 140 players in income pools, and as of this season, three of those players have made the major leagues.

MALONE: And Pando is now expanding. They’ve launched income pools for professional football players and are about to launch pools for business people – people graduating with MBAs and big ideas that may be worth a fortune or bupkis.

GOLDMAN: Tom Goldman.

MALONE: Kenny Malone.

GOLDMAN: NPR News.

(SOUNDBITE OF SNARKY PUPPY’S “XAVI”)

Copyright © 2019 NPR. All rights reserved. Visit our website terms of use and permissions pages at www.npr.org for further information.

NPR transcripts are created on a rush deadline by Verb8tm, Inc., an NPR contractor, and produced using a proprietary transcription process developed with NPR. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.