Today in Movie Culture: 'Star Wars: The Force Awakens' VFX Reel, Hologram Versions of Classic Movies

Here are a bunch of little bites to satisfy your hunger for movie culture:

Visual Effects Reel of the Day:

See why Star Wars: The Force Awakens was nominated for a visual effects Oscar today in this reel showing the making of practical and computer-generated spectacle:

[embedded content]

Cosplay of the Day:

This is part of a great photo shoot of Rey cosplay from Star Wars: the Force Awakens. See more images at KamiKame.

The Future of Movies?

Watch a couple of guys make hologram re-creations of scenes from The Big Lebowski, Apocalypse Now and more (via Devour):

[embedded content]

Film History Lesson of the Day:

Today is the 120th anniversary of the premiere of Birt Acres‘s Rough Sea at Dover, the first film publicly screened in England. Watch the then-thrilling short documenting waves crashing below.

[embedded content]

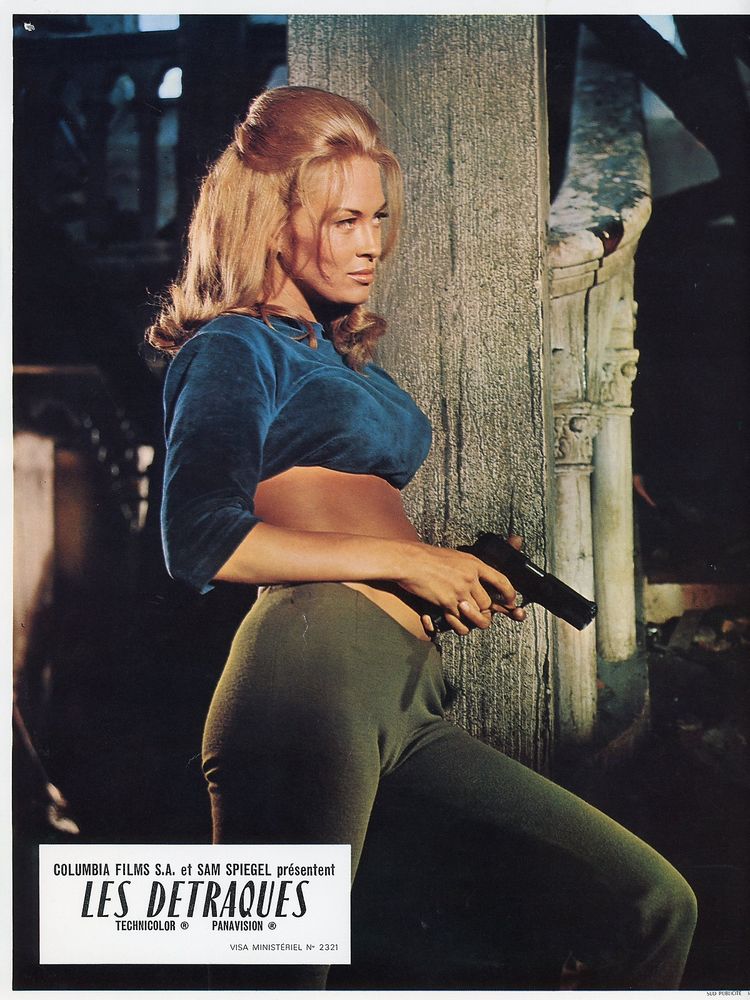

Vintage Image of the Day:

Happy birthday to Faye Dunaway, who turns 75 today. Here she is in a promotional photo for one of her first movies, The Happening, in 1966:

Reimagined Movie of the Day:

It’s hard to believe Dumb & Dumber could be sold as a highbrow romantic movie, but Mashable made it happen (via Geek Tyrant):

[embedded content]

Classic Cartoon of the Day:

Today is the 60th anniversary of the release of the classic Merrie Melodies animated short Bugs’ Bonnets, starring Bugs Bunny and directed by Chuck Jones. Watch the cartoon below.

Streaming Service Parody of the Day:

College Humor spoofs the Netflix original documentary series Making a Murderer and their partnership with Adam Sandler:

[embedded content]

Supercut of the Day:

Roman Holiday was commissioned by an international agency to make this montage of cinematic bedrooms, which includes bits from Iron Man and Ghostbusters:

[embedded content]

Classic Trailer of the Day:

Today is the 35th anniversary of the release of David Cronenberg‘s Scanners. Watch one of the original trailers from the horror classic’s UK run below.

[embedded content]

Send tips or follow us via Twitter:

and

This entry passed through the Full-Text RSS service – if this is your content and you’re reading it on someone else’s site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.